In case of a default, "There is a great chance that there is meaningful disruption to the U.S.

It's uncertain how much stocks could tumble, but when the nation came close to crossing that line in 2011 the market plunged 17%.

debt default would shake global financial markets, spurring many investors to sell stocks and bonds. Issued by Aware Super Pty Ltd ABN 11 118 202 672, AFSL 293340, the trustee of Aware Super ABN 53 226 460 365.Should you move money out of investments?Ī U.S. Aware Super financial planning services are provided by Aware Financial Services Australia Limited, ABN 86 003 742 756, AFSL No. You should also read our Product Disclosure Statement (PDS) and Target Market Determination (TMD) before making a decision about Aware Super.

#BITCOIN EXPERT FINANCE PLANNING PROFESSIONAL#

Before taking any action, you should consider whether the general advice contained in this website is appropriate to you having regard to your circumstances and needs and seek appropriate professional advice if you think you need it.

Further this website does not contain, and should not be read as containing, any recommendations to you in relation to your product. We have not taken into consideration any of your objectives, financial situation or needs or any information we hold about you when providing this general advice. This website contains general advice only. As crypto becomes more important to the organisations driving the modern economy, it’s entirely possible this medium of exchange could remain a safe haven for some time yet.Īware Super offers a broad range of expert services to help grow your advice business. Benefits and opportunities: Aside from investing directly in crypto, clients can buy the stocks of companies with exposure to cryptocurrency – a less lucrative but generally safer investment.As Gavin Brown, Senior Lecturer of Finance at Manchester Metropolitan University points out: “Cryptocurrency developers have traditionally spent too little time designing the business-use case for their coins and tokens, then only realising after launch that their idea is yesterday’s news.” However, more than 1,700 have been discontinued and become ‘dead coins’. Spoilt for choice: As of 2022, there are 19,000 cryptocurrencies in existence.

#BITCOIN EXPERT FINANCE PLANNING FREE#

It’s a jungle out there: While crypto is unregulated, making it free from the constraints of government oversight and influence, the exchanges that host these digital currencies can be susceptible to hacking, glitches and human error.As such, it’s incumbent on advisers to encourage clients to do thorough research and develop a strong sense of how the digital currency world works before they invest.

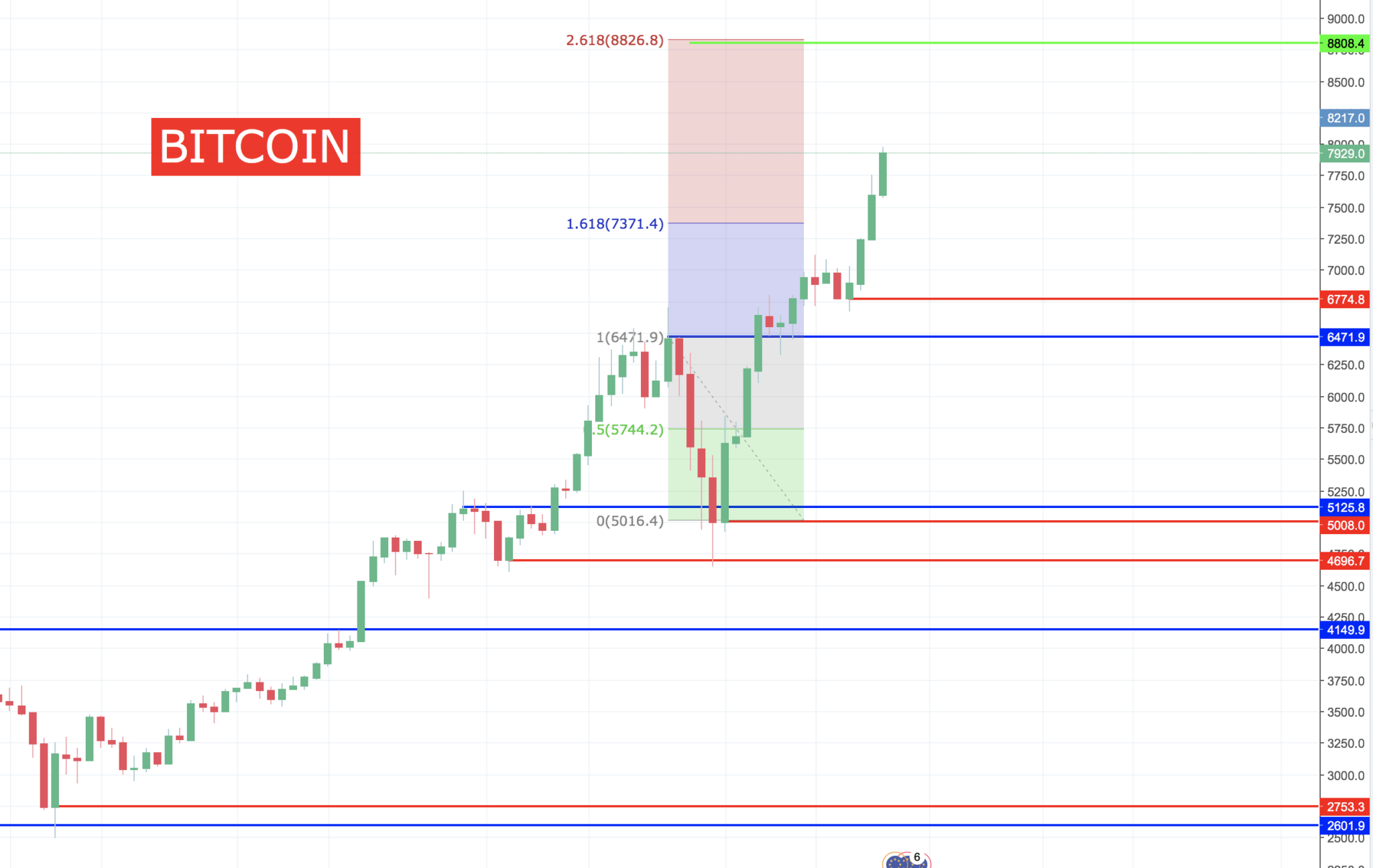

Buckle up: Clients must be made aware that crypto remains speculative and volatile, and that sudden changes in market sentiment can cause major fluctuations in this asset’s value.Still, this isn’t the first big dip the crypto market has experienced, and there is every sign that digital currency is here to stay. According to crypto tracking site CoinGecko, this downturn has led the prices of 72 of the top 100 tokens to tumble by more than 90% from their all-time highs. However, in the space of just seven months to June 2022, the crypto market has shed more than $1 trillion in value. Cognisant that gold is no longer the ‘TINA’ (there is no alternative) safe-haven asset it once was, high-net-worth clients have flocked to crypto in extraordinary numbers (in November 2021, the crypto market was worth a staggering $2.9 trillion). Since 2009, crypto has offered clients a new and, one might argue, more accessible, medium of exchange. Navigating clients to opportunity in times of crisis is intrinsic to your role as a financial adviser, and so it pays to know where those opportunities are. Traditionally, Australia’s thriving housing market has been a safe bet for clients, but with a recent analysis showing house prices could plunge up to 30% over the next four years, an increasing level of risk is creeping into this market, too.Įven gold – widely considered the most air-tight investment during market turmoil – is becoming a less effective hedge against moves in equities and inflation, according to investment management giant BlackRock. Between rising inflation, the global energy crisis exacerbated by Russia’s invasion of Ukraine, and now growing murmurs of a looming recession in the U.S, clients are eager to diversify their portfolios and seek out a safe-haven for their investments.

0 kommentar(er)

0 kommentar(er)